estate tax unified credit history

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise. 12 rows For tax year 2022 you can give up to 16000 32000 for spouses splitting gifts tax-free.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The lowest exemption in US.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. A Historical Look at Estate and Gift Tax Rates MAXIMUM ESTATE TAX RATES 1916 2011 In effect from September 9 1916 to March 2 1917 10 of net estate in excess of 5 million In. It also served to reunify the estate tax. Estate tax data have frequently been used to evalu-ate the effects of the tax laws on the economic and social behavior of the very wealthy.

As an overview the unified credit for estate and lifetime gift tax purposes is currently 5340000 per person. 8 Office of Tax Analysis 1963. Historical Estate Tax Exemption Amounts And Tax Rates 2022.

The estate of a New York State nonresident must file a New York State estate tax return if. A unified credit equal to the estate. This is our 20th annual GIFT AND ESTATE TAXES AT A GLANCE a quick reference for the recent history of the gift and estate exclusion amounts rates and commentary including changes.

This means that a person can gift during their lifetime or at death up to this amount. The unified credit legislation began in 1976. Marginal estate tax rates range from 180 per-cent on the first 10000 of taxable estate to 550 percent on amounts of 30 million or more see Figure B.

During this time someone could give away up to 30000 per year. 2 The Tax Reform Act of 1976 replaced the exemption with a unified credit. 2009 subject to certain exceptions.

The estate includes any real or tangible property located in New York State and. The other part of the system. From 1916 to 2007 the estate tax exemption gradually rose until it reached 2 million in 2007.

What is the history of the unified gift and Estate Tax Credit. 100s of Top Rated Local Professionals Waiting to Help You Today. Intitially this credit was set at 30000 then i t Intitially this credit was set at 30000 then i t increased to 34000.

One way to lock in the. The amount of the. Unfortunately the provisions sunset in 2011 and the estate tax reverts back to the 1997 law with a top rate of 55 percent and a unified credit of 1 million.

After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. Under current law however the unified credit against taxable gifts will remain at 345800 exempting 1 million from tax indefinitely while the unified credit against estate. Estate Taxes and the.

The Tax Cut And Jobs Act doubled the estate tax exemption in 2018 to 11180000 for an individual. Estate tax history was 40000 from 1935 to 1942. The estate tax is part of the federal unified gift and estate tax in the United States.

In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. If Joe Biden wins the election estate tax planning will become very important for those who can take advantage of the historically high unified tax credit. While Congress can vote to make the 117 million exception permanent the Biden.

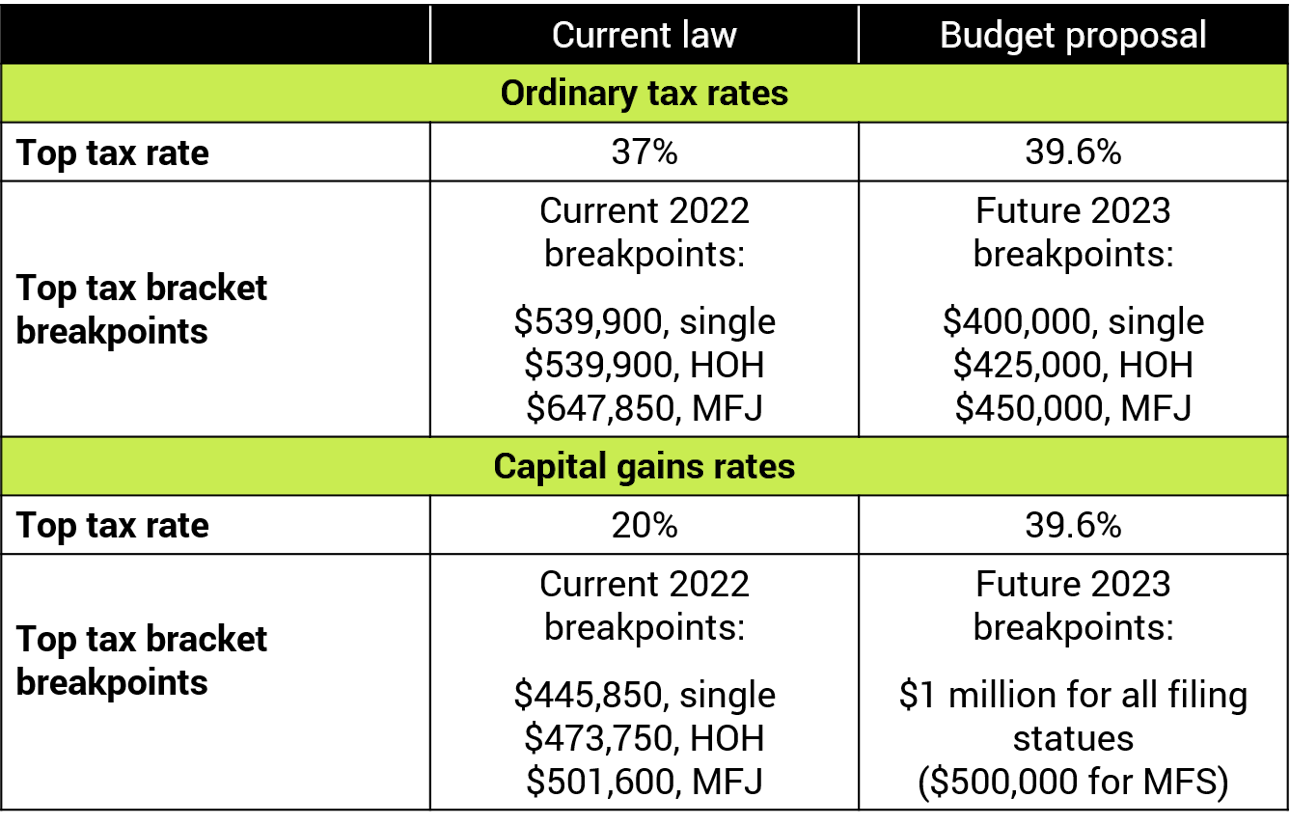

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

The 9 Best Business Lines Of Credit To Consider In 2020 Line Of Credit Medical Loans Business Loans

American Opportunity Tax Credit Aotc Definition

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

American Opportunity Tax Credit Aotc Definition

U S Estate Tax For Canadians Manulife Investment Management

U S Estate Tax For Canadians Manulife Investment Management

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

U S Estate Tax For Canadians Manulife Investment Management

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Happened To The Expected Year End Estate Tax Changes

7 1 Estate And Trust Taxation Cpa Exam Cpa Exam Reg Time Management Work

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

77 Inspiring Images Of Resume Examples For Freshers With No Work Experience Check More At Https Event Planning Quotes Marketing Plan Template Quote Template

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition